Participation Guide: NFT Time-Lock Vaults

How It Works

-

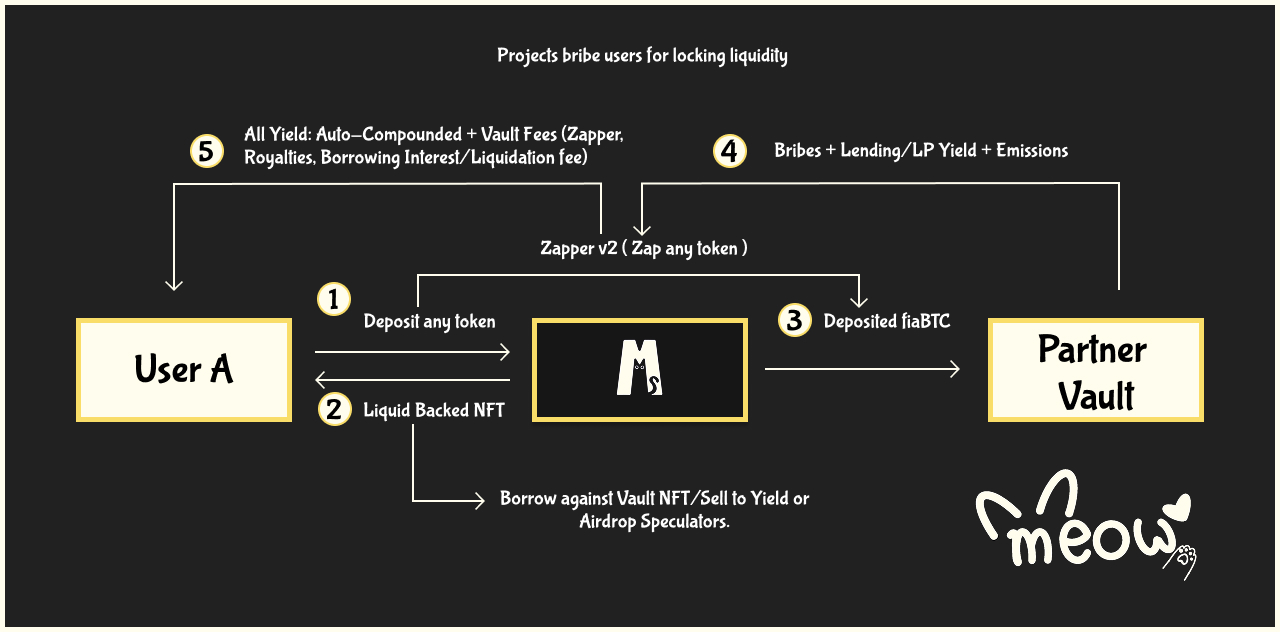

Deposit into the Vault:

- Users deposit liquidity into an NFT Time-Lock Vault and receive a liquid-backed NFT in return.

- If a user doesn’t hold the specific vault token, they can use Zapper to deposit using any token from any chain — all with the same single click deposit.

- The deposited liquidity is then routed to the partner’s vault to generate multi-layered yield.

-

Earn Yield:

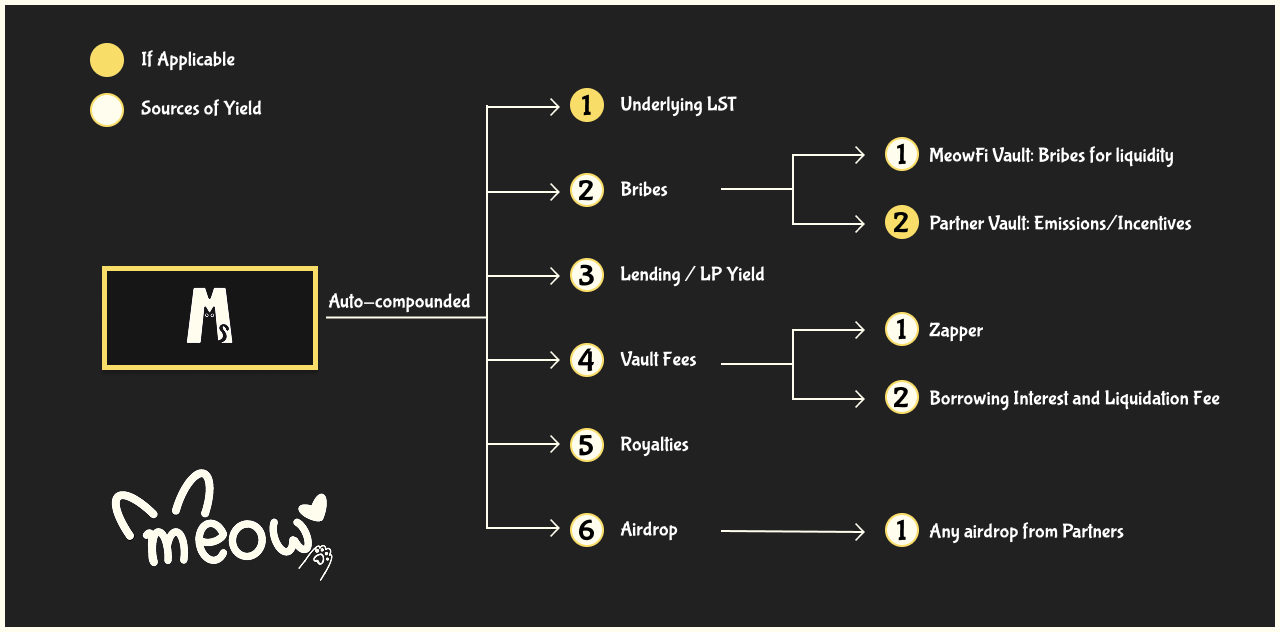

- While in the Vault, users earn auto-compounded yield from:

- Bribes from partnered protocols

- Lending or LP yield generated by the deposited assets

- Emissions and incentives from the underlying vault

- Vault fees, including:

- Royalties

- Zapper fees

- Borrowing interest

- Borrowing liquidation fees

- Instant redemption fees

- While in the Vault, users earn auto-compounded yield from:

-

Trade or Borrow Vault Positions:

- Borrow: The Unified Borrowing System allows users to borrow USDC against any position across our products — including LP tokens and liquid-backed NFTs.

- Trade: Users can trade their vault positions on supported marketplaces, providing liquidity and flexibility even during the lock-up period.

- Withdraw or Exit:

- Users can redeem their liquidity during the lock-in period by paying a fee, using the Instant Redemption option (if enabled by partners).

- Users can claim their liquidity or bribes at the end of the lock-up period or just it let stay there and still earn all the yield - compounded.

Infographic 1: How NFT Time-lock Vaults works

Infographic 1: How NFT Time-lock Vaults works

Benefits of NFT Time Lock Vaults

For Partners:

- Assured Liquidity with Low User Acquisition Cost

Projects can secure long-term liquidity without needing expensive marketing campaigns or high incentives to attract users. - Flexible Configuration

Our NFT Time-Lock Vaults support a wide range of setup:- single-sided desposit (any token)

- Dual-sided deposit (LP tokens)

- Custom vaults tailored for DEXs, lending protocols, prediction markets, and more (anything)

- Deep Integrations

- Zapper v2 Integration: Seamless cross-chain, one-click deposits

- Unified Borrowing System: Borrow against vault positions with ease

- Revenue Share from Vault Fees

Partner projects earn a share of the vault-generated fees, creating an additional revenue stream and incentivizing long-term collaboration and sustainability.

For Users:

-

Earn Without Strict Locking

Users can earn yield on locked assets while remaining liquid through their vault-backed NFTs. These Liquid NFTs can be used as collateral or freely traded on secondary markets. -

Multi-Layer Yield & Bribes

Users earn from at least six distinct sources going up to 10. These combined yield streams boost returns and increase the backing value of each NFT over time. -

Exclusive Airdrops & Additional Rewards

Vault participants receive special incentives like airdrops and perks from partnered protocols — unlocking more than just standard staking yield. -

Flexibility with Zapper & Unified Borrowing System

- Zapper v2: One-click deposits using any token from any chain

- Unified Borrowing System: Borrow USDC against any position in our ecosystem — LP tokens, Liquid NFTs, and more

Infographic 2: Sources of Yield in NFT Time-lock Vaults ( Min: 6 Sources )

Infographic 2: Sources of Yield in NFT Time-lock Vaults ( Min: 6 Sources )