NFT Time-Lock Vaults

The most capital-efficient vault out there, earn from everywhere, stay liquid throughout.

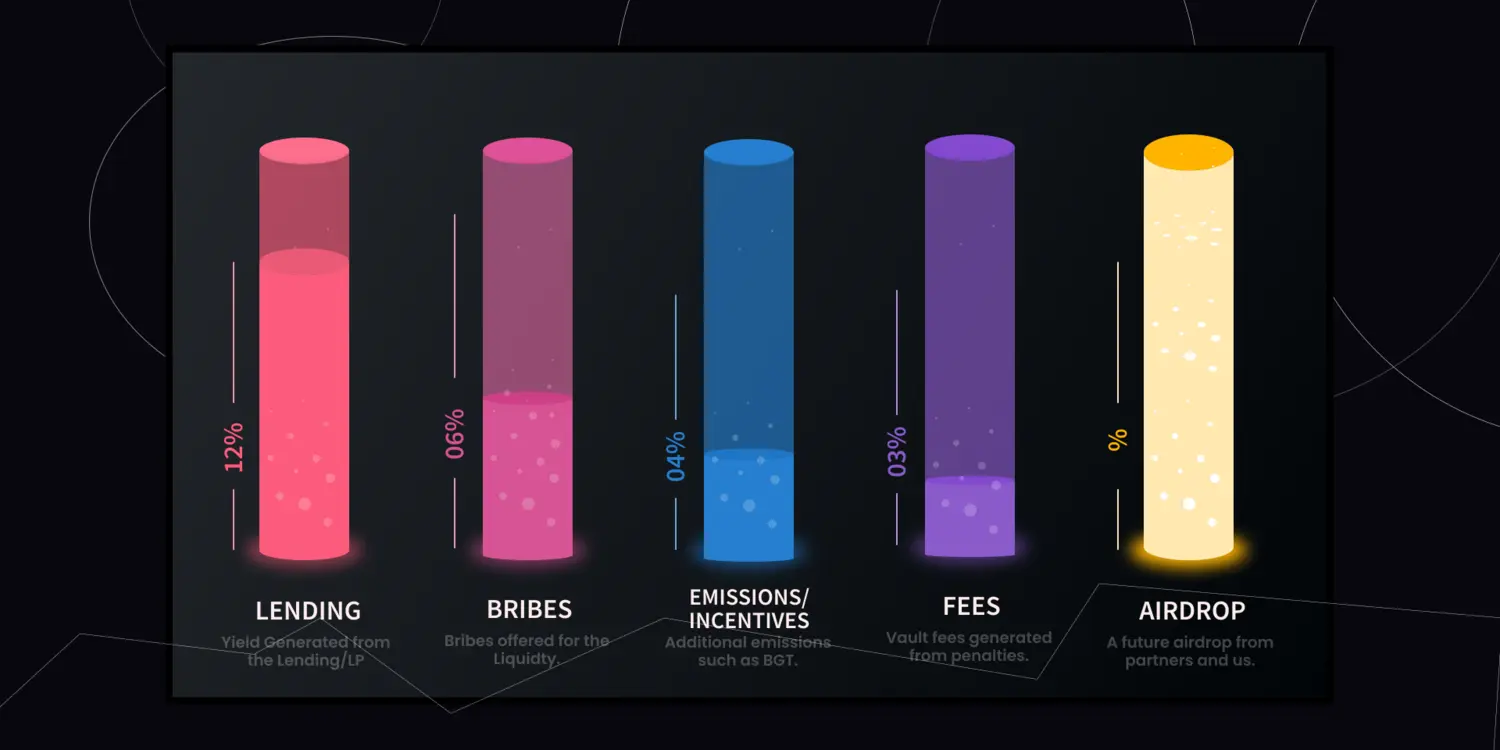

NFT Time-lock Vaults are next-gen liquidity vaults built to optimize capital efficiency and unlock additional layers of yield and liquidity by transforming locked assets into Liquid NFTs. When users deposit into these vaults, their liquidity is wrapped into a bribe-eligible, yield-generating POL NFT (Proof of Liquidity NFT) that accrues yield from multiple sources. Protocols offer bribes to secure long-term liquidity, while users benefit from enhanced, multi-layered yield — all without sacrificing flexibility. These Liquid NFTs remain fully composable, allowing users to borrow, trade, or exit early, making it the most seamless and capital-efficient way to put assets to work.

Configuartions

NFT Time-lock Vaults are modular and support:

- Single-Sided Vaults: Accept any token.

- LP Vaults: Lock LP positions from DEXes.

- Strategy Vaults: Route deposits into complex yield strategies or other on-chain products.

- Custom Vaults: Build vaults tailored for lending protocols, prediction markets, or experimental on-chain games.

Every vault can have its own lock duration, bribe settings, zapper config, and redemption logic. Whether it’s launching a token, bootstrapping TVL, or securing deposits, NFT Time-lock vault can do it all.

Comparing Direct Deposit of shMON/MON into Kuru Vault vs. via Meow’s NFT Time-lock Vault

| Feature/Yield source | Direct Deposit (Kuru) | NFT Time-lock Vault (Meow + Kuru) |

|---|---|---|

| 🌾 Base LP Yield | ✅ Yes | ✅ Yes |

| 💧 LST Yield from shMON | ✅ Yes | ✅ Yes |

| 🔁 Auto-Compounding | ✅ Yes | ✅ Yes |

| 🎁 Protocol Bribes | ❌ No | ✅ Yes |

| 💤 Yield on Idle Bribes (Universal Balance) | ❌ No | ✅ Yes |

| 🔁 Zapper Fee Yield (interoperable) | ❌ No | ✅ Yes |

| 💵 Borrowing Interest Redistribution | ❌ No | ✅ Yes |

| ⚠️ Liquidation Fee Redistribution | ❌ No | ✅ Yes |

| 🎨 Enforced NFT Royalties | ❌ No | ✅ Yes |

| 🔓 Instant Redemption Option & Fees | ❌ No | ✅ (If enabled by partner) |

| 🔄 Tradable Position | ❌ No | ✅ Yes (Liquid NFT) |

| 💰 Use as Collateral | ❌ No | ✅ Yes |