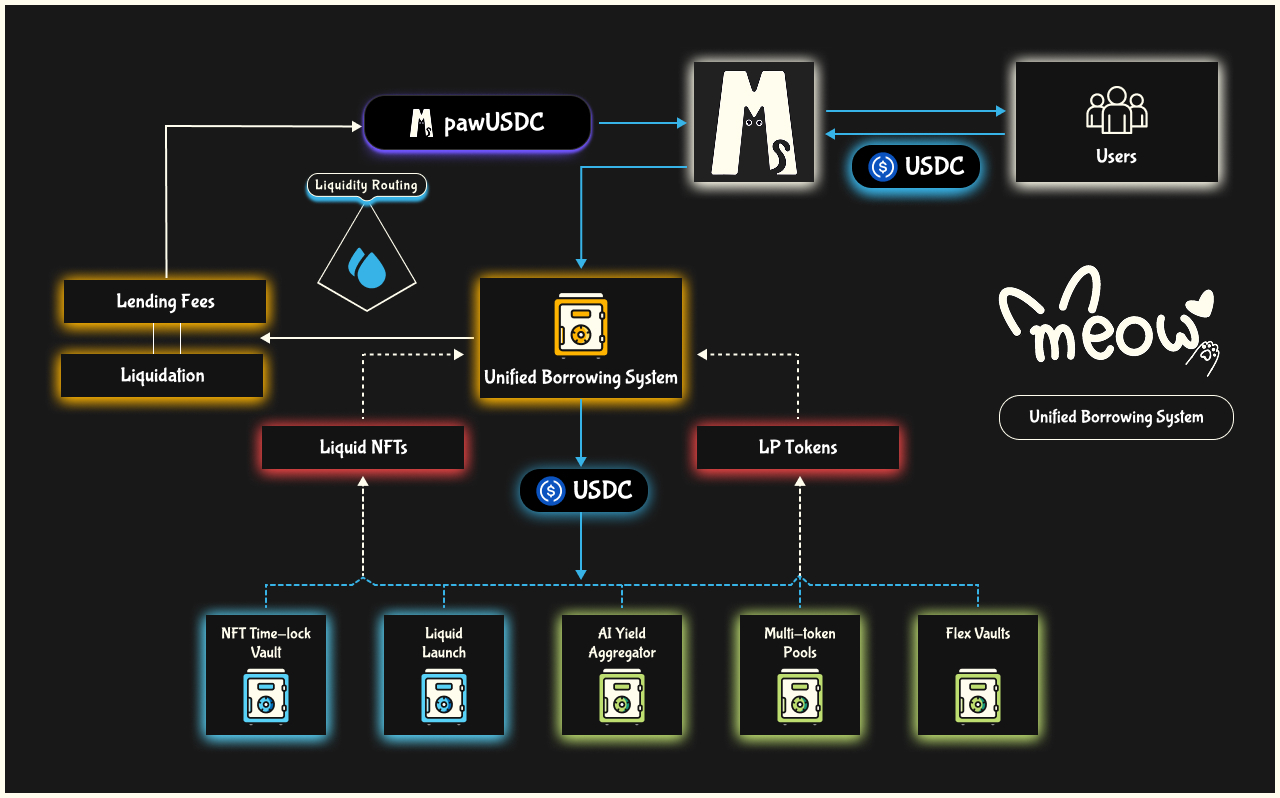

Unified Borrowing System

One Collateral liquidity Layer Across the Meow Ecosystem

Meow Finance’s Unified Borrowing System, powered by pawUSDC, enables users to borrow against any yield-bearing position within the Meow ecosystem — including NFT Time-Lock Vaults, Flex Vaults, AI Yield Aggregator, and more.

Key Features

- Borrow Against Any Position

Use LP tokens, vault receipts, or Liquid NFTs from Meow Finance as collateral. Borrow instantly against your yield-generating positions, unlocking additional layer of capital. - Backed by pawUSDC — a Unified USDC Layer

All borrowing draws liquidity from a single, protocol-owned pawUSDC pool — a DeFi-native, LST of USDC. This ensures deep liquidity, sustainable returns for lenders, and maximized capital efficiency. - Composable Leverage & Utility

Borrowed funds can be reused within Meow’s products or external protocols. Strategies like looping, stacking yields, or auto-compounding can all be built on top. - Designed for pawUSDC

pawUSDC earn interest, liquidation fees, and protocol yield sourced from vaults across the entire Monad ecosystem. No need to chase pools; pawUSDC aggregates everything into one yield-bearing token.**.

How It Works

- Deposit into any supported LP, vault, or yield strategy on Meow Finance.

- Receive a vault token or Liquid NFT representing your position.

- Borrow USDC against it instantly via the Unified Borrowing System.

Built for flexibility, powered by composability — Meow Finance’s borrowing layer is designed to unlock liquidity across every corner of our ecosystem.